A legacy of resilience

The next fifteen years marked a period of continued strong earnings. It also saw one of the most tumultuous economic times in many decades, including the sudden financial crisis that rocked the global economy in 2008, a crisis the Corporation and its group companies weathered better than most of their peers.

The financial crisis did not deter Power from its long-standing strategy: invest in a limited number of companies with the potential, over time, to develop dominant positions within their industry; work with strong management teams toward sustainable earnings, profitable growth, and shareholder value; and ensure that Power Corporation and its group companies maintain healthy balance sheets with which to ride out slower economic periods or seize new opportunities.

By the turn of the millennium, Power’s clearly defined strategy for its financial services business in Canada was to build a diversified financial services organization that would span a variety of life, health and retirement insurance plans under the Great-West Lifeco banner and that could also offer investment planning services and a host of investment products through Investors Group. Power quickly came to appreciate that distribution networks that complemented one another provided for greatly expanded reach with virtually no incremental costs. That was a key imperative as both Investors Group and Great-West Life grew through acquisitions.

Acquiring Mackenzie Financial

In 2001, Investors Group Inc. (subsequently renamed IGM Financial Inc.) acquired Mackenzie Financial Corporation, which was a highly regarded mutual fund company with an outstanding record of growth and performance. The $4.2 billion deal made IGM Financial Canada’s largest mutual fund organization, with more than two million clients, managed assets in excess of $74 billion, and a suite of exceptional product offerings and distribution channels. Three years later, IGM Financial grew yet again by purchasing a 75 per cent interest (later increased to 97.5 per cent) in Investment Planning Counsel, Canada’s fifth largest financial planning firm. In both instances, synergies created through the transactions spurred revenue growth but also allowed for significant cost savings.

While these acquisitions increased IGM Financial’s product portfolio it also expanded the channels through which these products could be sold. Investors Group had its own internal sales force which sold directly to individuals. (By the end of 2015, the sales force had grown to over 5,300 consultants.) Mackenzie Financial sold its products through a 30,000-strong network of brokers and independent financial planners authorized by the company. Investment Planning Counsel also dealt directly with financial planners, though on a smaller scale than Mackenzie. When it came to combining Investors Group, Mackenzie and Investment Planning Counsel, it was their mix of different distribution networks that made for such a solid strategic fit. As a result of these acquisitions, the distribution networks managed by Mackenzie and Investment Planning Counsel increased Investor Group’s market reach exponentially.

Adding a third powerhouse brand

Subsequent to its 1997 acquisition of London Life, Great-West Lifeco further secured its position as Canada’s leading life and health insurance operation in 2003 by acquiring Canada Life Financial for $7.3 billion.

Similar to the situation with IGM Financial, Great-West Life’s expansion gave it a multifaceted product portfolio and also added diversity to its distribution capabilities. Great-West Life was strong in group benefits, disability insurance and individual life insurance. London Life, through its Freedom 55 Financial™ division, offered its own brand of wealth management solutions and life insurance for individuals.

Canada Life, at the time of its acquisition, also offered insurance and wealth management products and services in Canada, the United Kingdom, Isle of Man and Ireland. Great-West Life had Gold Key, its own general agency sales force. London Life had its own sales force, and Canada Life had relied on independent brokers, who had no affiliation with any one insurance company, to sell its products. That created three different but complementary distribution channels for Great-West Lifeco.

This resulted in three powerhouse brands – Great-West Life, London Life and Canada Life – operating under Great-West Lifeco. With these new capabilities, Great-West Lifeco served more than 11 million Canadians.

Complementary Distribution Channels

Great-West Lifeco buys Putnam Investments

Also operating under Great-West Lifeco was Great-West Life & Annuity Insurance Company (subsequently rebranded Great-West Financial), which provided health insurance and retirement products in the United States. While Great-West Financial was growing organically, the decision was made to secure an acquisition in the U.S. market in line with Great-West Lifeco’s strategy of broadening its financial services business in the United States. This strategy was consistent with Power’s plans to gain a larger presence in that country.

In 2007, Great-West Lifeco acquired Putnam Investments, a world-class mutual fund brand based in Boston, for $4.6 billion. At the time of the acquisition, Putnam, which was established in 1937, was one of the oldest investment managers in the United States, with more than $225 billion in assets under management, approximately 3,000 employees, and overseas offices in London and Tokyo.

The Putnam brand was one of the strongest financial brands in the country and the acquisition represented a unique opportunity for Great-West Lifeco to assume a strategic position in the U.S. market for mutual funds and institutional assets. At the time of the acquisition, Putnam was experiencing challenging headwinds, later exacerbated by the financial conditions of 2008-2009. Through strong management and leadership, Putnam’s performance eventually strengthened and today is on a solid foundation to resume its former financial and growth performance.

A year later, Great-West Lifeco sold off its healthcare unit in the United States for an after-tax gain of $649 million, because of the consolidation taking place in the sector and concerns that the unit could not provide the scale required for long-term success.

In both Canada and the U.S., growth through acquisition gave Power a formidable mix of complementary capabilities such as both group and personal life insurance, mutual fund offerings and personalized financial advice, along with a sales and advisor network among the largest in North America.

A new CEO takes the helm at Power Financial

A number of significant management changes took place during this period as well. In 2005, the Board of Directors of Power Financial Corporation appointed R. Jeffrey Orr as President and CEO. Mr. Orr was formerly President and CEO at IGM Financial and had started his career in 1981 at BMO Nesbitt Burns where he worked on a number of transactions for Power, including the creation of Power Financial and numerous, subsequent financial transactions and therefore developed an intimate knowledge of the Power group of companies. In 1999, he was named Chairman and CEO of BMO Nesbitt Burns, a position he held until joining IGM Financial as President and CEO in 2001. Mr. Orr is credited with guiding Power’s portfolio companies through the most significant economic downturn since the Great Depression. He also led Power Financial through several major acquisitions, including Putnam Investments and Irish Life.

Also in 2005, Robert Gratton became Chairman of the Board of Power Financial Corporation, after having served as President and CEO since 1990. In 2008, he retired as Power Financial Chairman and, in 2014, did not stand for re-election as a Director for Power Financial and Power Corporation. In recognition of his outstanding contribution to the Power group of companies over many years, the Board of Directors of Power Corporation appointed him Deputy Chairman Emeritus in May 2014.

During Mr. Gratton’s 15-year tenure as President and CEO, Power Financial’s annual compound total return to shareholders was 23 per cent and market capitalization grew from $1.5 billion to $23.5 billion. Prior to joining Power, Mr. Gratton was appointed in 1982 as the Chairman, President and Chief Executive Officer of Montreal Trustco where he increased the firm’s value by a factor of 13.

Refocusing on global reach

Pargesa’s primary holding, Groupe Bruxelles Lambert (GBL), continued to modify its portfolio with an eye to investments in companies that had global market reach and thus larger foundations on which to build and grow their businesses.

Suez, formerly Suez Lyonnaise des Eaux, merged with Gaz de France in 2008 to create GDF Suez, one of the largest gas groups in the world, particularly in the liquefied natural gas sector, while putting its water and waste management operations into Suez Environnement.

GBL’s shares in CLT-UFA (which as a result of a merger became RTL Group, Europe’s leading broadcast company) were exchanged in 2001 for 25 per cent of Bertelsmann AG, then one of the world’s foremost media companies. The transaction allowed the Pargesa group’s media interests to evolve into a diversified global media business. In 2007, GBL sold its stake to Bertelsmann’s controlling shareholder.

In 2006, GBL made a new investment in Lafarge, a world leader in the cement and building materials sector, and a year later it bought a stake in Pernod Ricard, a global leader in wines and spirits.

to2011

Developing alternative asset management businesses

Throughout its evolution, Power Corporation has invested in non-financial sector investment platforms to achieve superior returns and stable cash flows. Initially holding investments in third-party managed funds, Power Corporation decided, in the early 2000s, to develop its own investment platforms.

In 2002, Sagard SAS was established in Europe, followed by Sagard Capital Partners in the United States in 2004. Since its founding in 2005, Sagard has evolved into an alternative asset management firm that invests across four asset classes: venture capital, private equity, credit, and real estate. It provides flexible capital, fosters an entrepreneurial culture, and leverages a global network of investors, commercial partners, advisors, and value creation experts.

Power Sustainable, a climate-focused investment manager, offers institutional investors exposure to alternative assets which aim to accelerate and scale sustainable solutions across multiple industries, including energy infrastructure, infrastructure credit, and agri-food private equity. It aims to create long-term value by investing in decarbonization, social progress, and quality growth. At the end of 2024, its platforms included Power Sustainable Energy Infrastructure, Power Sustainable Lios, and Power Sustainable Infrastructure Credit.

As an investor, Power Corporation employs a value approach characterized by deep fundamental analysis. The Corporation seeks influence through involvement with investee companies and leverages its global network for long-term capital appreciation. Each of the Sagard and Power Sustainable investment platforms adheres to Power Corporation’s investment philosophy and governance model.

Managing the 2008 global financial crisis

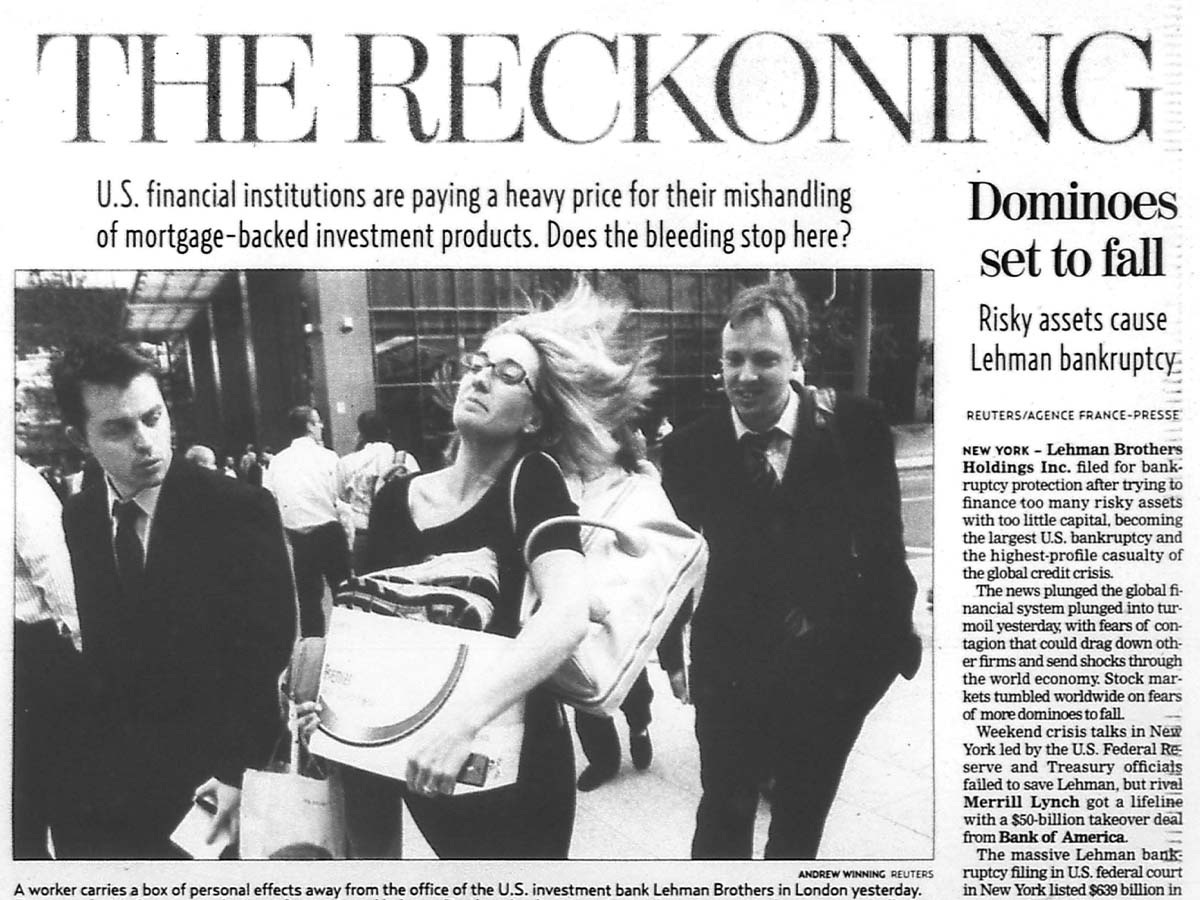

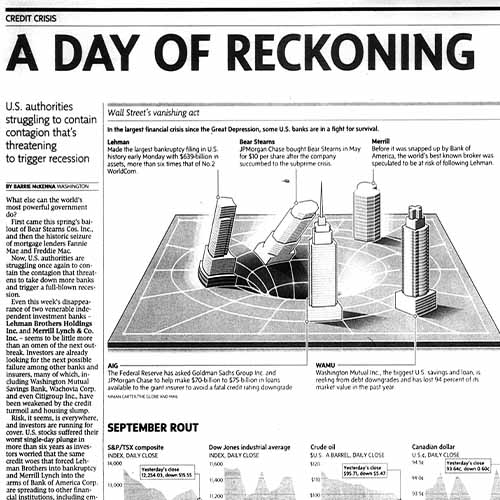

In 2008, a global financial crisis arose, the likes of which had not been seen since the Great Depression. Equity markets dropped pervasively, bond markets froze and blue-chip financial firms such as Bear Stearns and Lehman Brothers disappeared virtually overnight. Governments launched stimulus packages and corporate bailouts. Central banks pushed interest rates to historic lows and kept them there. In Europe, the sovereign debt crisis threatened to decimate national financial infrastructures as the spectre of default loomed.

While Power did have investments in Europe through Pargesa, the foreign debt crisis did not have a meaningful impact on either Pargesa or Power. The strength of Pargesa’s balance sheet had largely protected it from sovereign debt issues.

Power and its companies have always adhered to a philosophy of prudent management, which positioned them to weather the global financial crisis effectively. Although the Corporation’s net income and share price were negatively impacted, the Power Group performed solidly during the severe economic downturn.

As one example, Great-West Lifeco was one of only two publicly traded life insurance companies in North America not to be downgraded during the crisis and maintained its dividend.

Common strengths at IGM Financial and Great-West Lifeco allowed both companies to weather this period of low interest rates. In the case of Great-West Lifeco specifically, given the payout nature of its business, low interest rates can pose a particular challenge. However, the company successfully managed its operations so as to meet its ongoing payout obligations through a consistent cash flow.

The performance of the Power companies was achieved not by actions they took when the crisis occurred. Rather, their performance endured because of the quality of their businesses and products coupled with Power’s long-standing business strategy: maintain strong financial positions, adopt prudent investment practices and a long-term perspective, and maintain active involvement and oversight through the boards of directors of its group companies.

Most importantly, strong performance was also driven by highly talented management teams at each of the subsidiary companies who were supported by senior Power executives who sat on their boards of directors.

Once the crisis began to pass, new initiatives were launched to regain a trajectory of growth where opportunities existed.

Evolving Power board structure

Subsequent to the financial crisis which began in 2008, Power took the opportunity to re-evaluate its governance structure. The number of directors was reduced from 21 to 12. Related Party and Conduct Review Committees were created at the boards of Power Corporation and at all of its publicly traded subsidiaries.

Power’s governance model remains defined by the philosophy of making long-term investments, providing active ownership and close oversight of its subsidiaries as a means of driving performance, and by contributing to the communities in which it operates.